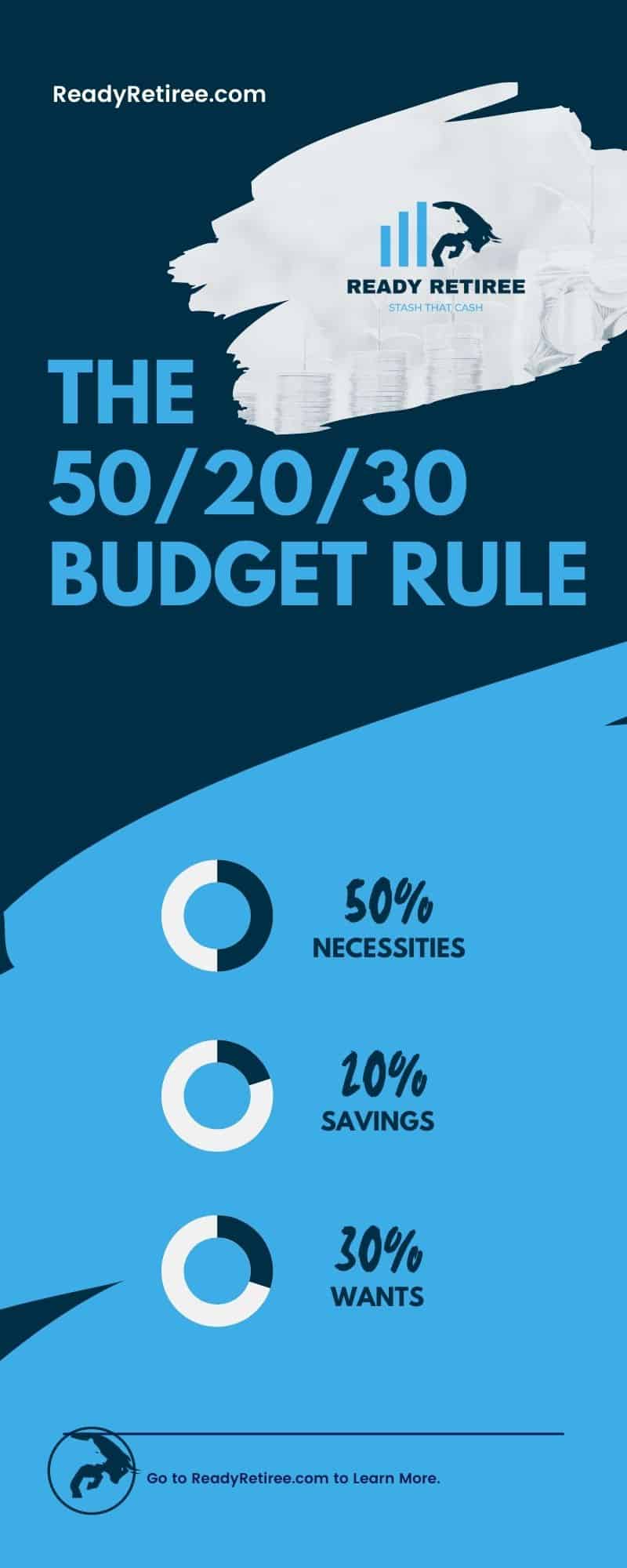

The 50/20/30 Budget Rule is a simple and effective way to manage your finances. This rule divides the money that you have available for spending into three categories: 50% on necessities, 20% on savings, and 30% on wants. It’s not just about budgeting money; it also helps you make smarter decisions when deciding how to spend your hard-earned cash.

Could the 50/20/30 Budgeting Plan Simplify Your Finances?

The 50/20/30 Budgeting Rule is a great way to organize your finances and make the most of what you earn. By tracking how much money goes towards necessities, wants, and save each month, can help you make better purchasing decisions when shopping for clothes or going out with friends. The rule also encourages people to save more because they see their hard-earned cash go further than ever before by applying this simple budgeting plan!

Writing about numbers in sentences? It’s not necessary here since we’re talking about just one topic – but if there are multiple items that need numbering then I would recommend using bullet points instead. If that doesn’t work well either then try rewriting the post to including any number lists at all

How To Use the 50/20/30 Rule of Thumb for Budgeting

The 50/20/30 Rule of Thumb is a simple and effective way to manage your finances. Here’s how it works:

50% on Necessities

Things like rent, transportation costs, groceries, etc. This category should cover the essentials! Sometimes people lower this percentage because they intend to get even more serious about saving money by reducing their expenses or earning extra income through side jobs.

20% on Saving

One could argue that only saving 20% of your finances isn’t enough, but in reality, this is probably higher than the average person currently saves in a year. It’s an achievable percentage that should be possible for just about anyone. Really consider what you can cut out of your budget and think about how much your going to watch that money compound over the next several years!

30% on Wants

This includes clothes, entertainment (movies/dinners out), new technology items that you want but don’t need right away; basically all discretionary spending for the fun stuff! Some people raise this percentage if they find themselves having leftover cash after meeting their monthly needs and goals — perhaps they can afford some luxury purchases without feeling guilty.

What Counts as After-Tax Income?

After-tax income is the amount of money you have to spend after taking out taxes and other deductions from your paycheck. You can calculate it by subtracting what you pay in taxes, health insurance premiums, retirement contributions (401k), etc., from your total salary.

What do we mean when we say “after-tax” income? This means that anything taken off a person’s monthly earnings before they receive their final check for work done counts as pre-tax – including things like social security or medicare payments. If someone made $50K per year then deducted 100% of those two items from each month’s take-home…that would be considered pre-tax since it has been removed prior to receiving the balance left over for spending!

Where does credit card debt go in the 50/30/20 rule?

The 50/30/20 rule is a budgeting guideline stating that you should allocate 50% of your income to necessary expenses, 30% to wants, and 20% to savings. For many people, their credit card debt will fall within the “wants” category since it’s not considered an essential expense like rent or gas; however, high-interest rates on outstanding balances can quickly change this situation!

How does credit card debt factor into this plan? This type of consumer borrowing would typically be placed in the discretionary spending portion of things – meaning we’re talking about items such as new clothes for work or going out with friends once per month. If someone has $3000 total between all three cards then they could pay off one each month until done

What types of debt should be considered in the 20% of savings and debt?

In the 20% of savings and debt category, credit card debt is usually included – along with loans for a house or car. If you’re saving up to buy something in particular then this would be considered another form of “wants” spending since it’s not an essential need by any means!

Is there a type of debt that should be excluded from the 20%? Student loan payments typically aren’t counted as part of someone’s discretionary income so they could opt to put even more towards those each month if they wanted. For many people though these are necessary expenses in order to get ahead financially by starting their career on solid footing through education.

What about 401k contributions? While retirement plans can sometimes fall into your pre-tax earnings, it’s more common to see these funds included as part of your after-tax earnings since you’re not getting that money back until much later in life when you retire.

These are just some examples to keep in mind – everyone has a different financial situation so there isn’t one “right” answer for all! Calculating what goes where can be daunting, but once people get started they often find it easier than expected and the plan starts to make sense over time.

Who should look for a different budgeting strategy?

There are many different strategies for budgeting, but the 50/30/20 rule is just one of many to try. If you’re working towards a particular goal or want more freedom in your spending then it might make sense to switch up this guideline and see how things work out!

If there’s no underlying reason for using this strategy though – it can be hard to maintain since most people go with their gut instincts when making purchases. This means that allocating too much money towards “wants” may end up being impossible over time without some additional changes elsewhere in life!

Do I need any other tools? Tracking software like Mint can help save time by automatically compiling everything into one place so that someone doesn’t have to manually enter numbers every single month. This offers a lot of conveniences while also helping to eliminate human error when it comes to budgeting which can result in less frustration all around!

What other benefits are there? Other than saving time and money, using something like Mint might make you more accountable for your spending habits since this information is always available whenever needed. If someone makes the effort to check their account daily then they’re much less likely to go overboard each month with purchases that may not be entirely necessary – resulting in an easier time sticking within the guidelines set out by whatever system they choose!

Options to Start Saving for Retirement

Now that you’ve made the commitment to start saving, where do you start? Below are some of our favorite options for beginners or those that are looking for an easy way to budget their savings.

- Acorns | the only account that saves and invests for you.

- Rocket Dollar - Alternative Asset Retirement Accounts

Acorns offers checking accounts, debit cards, investment platforms, and more all in one place. Acorns became famous for automatically rounding up your purchases to invest like 'acorns'. Their product offerings have expanded, but it is all centered around helping you save.

We earn a commission if you make a purchase, at no additional cost to you.

We earn a commission if you make a purchase, at no additional cost to you.

Is the 50/30/20 rule budget right for you?

This is a great guideline for many people to start with – especially those who may be struggling when it comes time to make decisions about the money. It’s an easy way to take control of your finances without much effort at all since the plan only requires you to divide up your earnings into three categories and then stick with that each month until it feels right!

While this strategy can work well for most people, there are also other options out there if someone wanted something else. If they don’t have any reason in particular then trying a different system might lead them down a more rewarding path over time instead of simply going through the motions every single month, resulting in less frustration overall!